Retail Real Estate Trends: What's Next for Your Business

Written by: Clyde Christian Anderson

The Retail Renaissance Defies Expectations

Retail real estate trends are proving the "retail apocalypse" predictions wrong. Instead of widespread closures, we're seeing a remarkable renaissance driven by record-low vacancy rates and steady growth.

The current retail real estate landscape shows remarkable strength:

- Vacancy rates at 15-year low - Shopping centers nationwide hit their lowest vacancy rates since 2007

- Steady rent growth - Average asking rents increased 4.1% year-over-year in Q4 2024

- Strong consumer spending - Retail sales up 5.2% year-on-year despite economic uncertainty

- Limited new supply - Only 4.5 million square feet delivered in Q1 2025, creating scarcity value

- High occupancy rates - Shopping centers reached decade-high occupancy of 95.6%

The data tells a clear story: physical retail isn't dying - it's changing. Retailers are adapting with smaller footprints, experiential concepts, and omnichannel strategies that blend digital convenience with in-person experiences.

What's driving this resilience? Consumer behavior has shifted toward necessity retail, experiential shopping, and convenience-focused formats. Mixed-use developments are replacing traditional malls, and high-growth markets are experiencing explosive growth. Retailers are also finding that physical stores boost online sales rather than compete with them.

But this change brings new challenges. Construction costs are 30-40% above pre-pandemic levels, interest rates remain high, and competition for quality space is fierce.

I'm Clyde Christian Anderson, founder of GrowthFactor.ai. With a background in retail since age 15 and experience helping clients achieve $6.5M in new revenue through data-driven site selection, I've seen how these retail real estate trends are reshaping the industry.

Find more about retail real estate trends:

The New Rules of Retail: How Consumer Behavior is Reshaping the Landscape

The old retail playbook has been rewritten. Today's consumers seek experiences, demand convenience, and expect brands to meet them anywhere. These shifting behaviors are creating new retail real estate trends that smart investors and retailers can't afford to ignore.

Understanding these changes isn't just about staying current—it's about survival. The retailers and property owners who recognize these shifts early are the ones capturing market share and commanding premium rents. Let me walk you through the three fundamental changes reshaping everything from mall design to Data Driven Site Selection.

The Experience Economy: From Transactions to Destinations

Walk into any successful retail space today, and you'll notice it's not just about buying anymore—it's about being somewhere. This shift toward experiential retail is one of the most powerful retail real estate trends we're seeing.

Gen Z shoppers are driving this change. Despite growing up digital, they seek physical spaces for social connection and authentic experiences. They want Instagram-worthy moments, hands-on interactions, and spaces that feel like destinations.

Interestingly, indoor malls are actually outperforming open-air shopping centers in foot traffic growth. Why? Because successful malls have transformed into community hubs with diverse tenant mixes that go far beyond traditional retail.

The most successful properties are embracing "retailtainment." We're seeing shopping centers add medical offices, fitness studios, pickleball courts, and even luxury apartments. These mixed-use developments create multiple reasons for people to visit, increasing dwell time and cross-shopping.

This shift toward placemaking means tenant diversity is crucial. Properties that rely solely on traditional retail are struggling, while those offering experiences alongside shopping are thriving. When we help clients with Retail Location Analysis, we're not just looking at demographics—we're analyzing lifestyle patterns and experiential preferences.

The Phygital Fusion: Integrating Online and Offline Worlds

Contrary to old predictions, e-commerce hasn't killed physical stores. Instead, we're witnessing the rise of "phygital" experiences that seamlessly blend online and offline shopping.

Physical stores are becoming fulfillment powerhouses. Buy Online, Pick Up In Store (BOPIS) has exploded in popularity, offering online convenience with immediate gratification. Stores are redesigning layouts to accommodate these new functions with dedicated pickup areas and streamlined return processes.

But here's the real game-changer: a study on physical retail's impact on online sales shows that opening a brick-and-mortar location increases online sales in that market. Physical stores serve as powerful brand experience centers, allowing customers to connect with products in ways digital platforms can't replicate.

Digitally native brands are leading this omnichannel strategy. They use physical spaces for immersive brand experiences while leveraging their online presence for convenience. Success isn't about choosing between channels—it's about making them work together seamlessly.

For retailers navigating this landscape, having the right analytical tools is essential. Our AI Powered Retail Analytics platform helps clients understand how online and offline performance interact, ensuring their location decisions support their entire brand ecosystem.

Convenience and Value: The Rise of "Necessity Retail"

While experiences draw people in, the demand for convenience and value is another powerful force shaping retail real estate trends. This has led to the remarkable strength of what experts call "necessity retail."

Grocery-anchored centers are the stars of today's retail market. These neighborhood centers consistently show the lowest vacancy rates because they generate steady, recession-resistant foot traffic and provide the convenience busy consumers crave.

The necessity retail category extends beyond groceries to include discount retailers, pharmacies, and quick-service restaurants (QSRs). These businesses serve daily needs and have proven resilient to economic pressures and e-commerce competition.

This focus on value and convenience is reshaping store formats. QSRs are prioritizing locations with drive-throughs, and retailers are emphasizing efficiency. The lesson for anyone evaluating retail opportunities? Understanding How to Choose Retail Location means recognizing that the most successful properties serve daily routines and provide immediate value to their communities.

These three shifts—toward experiences, phygital integration, and necessity retail—are the new fundamentals of retail success, creating opportunities for those who understand how consumer behavior is reshaping the entire landscape.

Key Retail Real Estate Trends in Development and Investment

The development and investment landscape for retail real estate has transformed. We're now seeing a fascinating paradox: strong demand meeting severely limited supply, creating unique opportunities. This environment is reshaping how developers, investors, and retailers approach physical space.

The story begins with a decade of underbuilding, continues with a strategic shift toward smaller, more efficient formats, and culminates in the explosive growth of dynamic markets that are rewriting the rules of retail geography.

The Supply Squeeze: Why New Construction is at a Historic Low

Only 4.5 million square feet of new retail space was delivered in Q1 2025, a fraction of the historical average of nearly 40.8 million square feet per year from 2008-2014. This dramatic undersupply is now a defining retail real estate trend.

With less than 20 million square feet projected for delivery in all of 2025, we're looking at the most supply-constrained retail market in decades.

Several forces have created this bottleneck. Construction costs have surged 30-40% above pre-pandemic levels, making new projects financially challenging. Rising interest rates compound the problem by making it difficult to finance new developments.

The ripple effects are everywhere. Overall availability rates have held steady at 4.8% through Q1 2025. This scarcity is driving asking rents up approximately 2% in 2025, with some analysts suggesting retail is the only traditional commercial real estate sector positioned for real rent growth.

For retailers, this means fierce competition for well-located space. For investors, it creates opportunities in markets where demand outpaces supply. Understanding these dynamics is where tools like Real Estate Investment AI become invaluable for making informed decisions.

"Less is More": One of the Biggest Retail Real Estate Trends is Strategic Downsizing

A walk through any new shopping center reveals a clear trend: smaller spaces. Over 68.5% of leasing deals in Q1 2024 were for spaces of 2,500 square feet or less, with retailers shrinking their average store footprint by approximately 2% per year.

This isn't about weakness—it's about optimization. Smaller formats offer compelling advantages that align with modern consumer behavior and economic realities.

Lower operational costs are the obvious benefit, helping retailers manage margins. But the real magic is improved efficiency. These curated smaller spaces often generate 25% higher sales per square foot because every inch is optimized.

More importantly, smaller stores cater to the consumer desire for convenience. Post-COVID shopping habits emphasize quick, in-and-out experiences, and these compact formats deliver exactly that.

This downsizing trend is also fueling creative adaptive reuse projects. Developers are reimagining defunct big-box stores as mixed-use developments that combine retail with residential, office, and entertainment. These projects typically achieve higher occupancy rates and generate premium rents because they create vibrant live-work-play environments.

The shift toward smaller, flexible spaces changes how retailers approach expansion. Success now depends on finding the right mix of location, format, and community integration—a complex analysis that benefits from a comprehensive Retail Store Expansion Strategy.

Hot Spots: The Rise of High-Growth Markets

To find the future of retail real estate, look toward high-growth markets across the nation. While the Sun Belt has seen remarkable expansion, the underlying drivers—population migration, economic diversification, and business-friendly climates—are creating opportunities in various regions.

People are moving from high-cost urban cores to more affordable suburban and secondary markets, bringing their purchasing power with them. These markets often feature robust job growth in sectors like technology and healthcare, supporting sustained retail demand. As a result, markets from the Southeast to the Southwest, and even revitalized areas in the Northeast, are showing low vacancy rates and strong leasing activity.

Business-friendly regulatory climates in many of these growth states make it easier and more cost-effective to open and operate retail locations, creating an environment where retailers can thrive.

For retailers and investors, identifying these high-growth markets early is crucial for success. The combination of demographic trends and economic fundamentals creates compelling opportunities, but only for those who can analyze the complex factors that drive sustainable growth. That's where sophisticated Real Estate Site Selection becomes essential for navigating these dynamic markets.

Navigating Market Forces: Economic, Social, and Governance Factors

Beyond shifts in consumer behavior and development, broader economic, social, and governance forces are reshaping retail real estate trends. Think of these as invisible currents that can propel an investment forward or create challenges. Understanding these forces isn't just about risk management—it's about spotting hidden opportunities.

Economic Headwinds and Tailwinds for Retail Real Estate Trends

The economic environment for retail real estate trends is mixed, but the sector has proven remarkably resilient. Despite predictions of doom and gloom, the outlook has positive elements.

On the positive side, consumer spending remains surprisingly strong with a 5.2% year-over-year increase in retail sales. A robust labor market and post-pandemic savings continue to fuel spending, supported by Moody's forecast for steady GDP expansion through 2025.

However, challenges remain. Inflation is making consumers more selective, prioritizing value and experiences. Rising interest rates make capital more expensive, which can slow expansion. But this same factor contributes to the supply shortage, benefiting existing property owners through higher rents and lower vacancy.

Recession fears also make some retailers cautious, but the "necessity retail" formats—grocery-anchored centers, discount retailers, QSRs—tend to be recession-resistant by nature.

For our clients using Commercial Real Estate Portfolio Management Software, having real-time access to economic indicators helps them adjust strategies proactively.

The Growing Importance of ESG in Real Estate Valuation

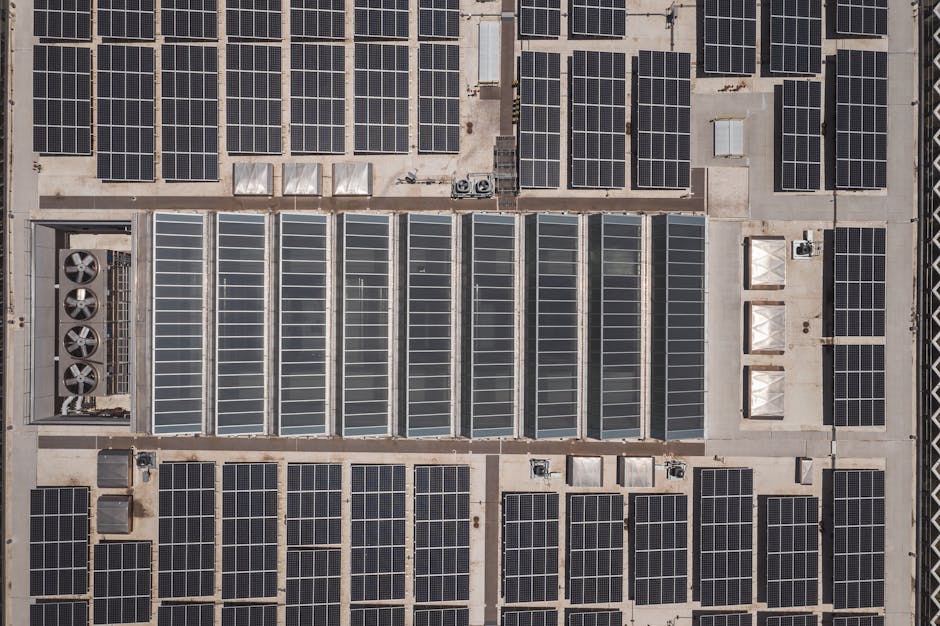

Those solar panels on the building above aren't just good for the environment—they're good for business. ESG principles have evolved from buzzwords to value drivers in today's retail real estate market.

The reason is simple: ESG-compliant properties perform better financially. Energy-efficient systems, LED lighting, and solar panels don't just reduce a carbon footprint—they cut operating costs. ESG as a value driver in real estate is no longer theoretical; it's showing up in property valuations.

Tenants are increasingly drawn to sustainable properties to meet their own sustainability goals. This creates a virtuous cycle: ESG-compliant buildings attract better tenants, achieve higher occupancy, and can command premium rents. Green financing discounts from lenders like Fannie Mae and Freddie Mac make the financial case even stronger.

Institutional investors are paying attention, scrutinizing ESG performance as part of their investment criteria. It's about future-proofing investments against climate-related risks and potential regulatory changes.

The smart money integrates ESG from day one. Our AI for Property Development platform can help identify opportunities to incorporate these features from the earliest planning stages.

Overcoming Challenges: Risks and Mitigation Strategies

Every opportunity comes with risks, and retail real estate trends are no exception. The key isn't avoiding risks but understanding them well enough to steer successfully.

Capital access has become trickier in the current interest rate environment, forcing developers to be more creative with financing.

Tenant bankruptcies remain a reality. The key is choosing tenants wisely and maintaining diverse tenant mixes that don't rely on any single business model.

Cybersecurity threats are growing rapidly in real estate. According to the 2024 AFP Payments Fraud and Control Survey Report, 80% of organizations were targets of payments fraud in 2023. Protecting sensitive financial and tenant information is crucial.

The most effective approach combines portfolio diversification with strategic flexibility. Spreading investments across different retail formats and focusing on resilient tenant categories provides long-term protection.

Strong partnerships with local governments and community stakeholders can also help steer zoning challenges and ensure developments align with community needs.

Effective AI Lease Management is essential in this environment, helping property owners track performance, identify issues early, and make data-driven decisions. The goal is to understand risks well enough to build resilient portfolios.

Frequently Asked Questions about Retail Real Estate Trends

I get these questions all the time from clients and investors trying to make sense of today's retail landscape. Let me share the answers that matter most for your business decisions.

What is the biggest trend in retail real estate right now?

The biggest retail real estate trend is the shift toward smaller, experience-focused spaces that seamlessly blend online and offline shopping. Retailers are embracing footprints under 2,500 square feet while creating destinations that offer more than just transactions.

This change is happening fastest in high-growth suburban and secondary markets where population growth is driving demand. The trend is accelerated by a severe construction shortage, with only 4.5 million square feet of new retail space delivered in Q1 2025, far below historical averages.

The result is fierce competition for prime locations, vacancy rates at 15-year lows, and rent growth that's outpacing most other commercial real estate sectors. Smart retailers are adapting by focusing on omnichannel integration, where physical stores boost online sales and serve as brand experience centers.

Is physical retail dying because of e-commerce?

Not at all—the data proves it. The "retail apocalypse" story was a myth. Physical retail is evolving, not dying.

Here's what's actually happening: e-commerce and physical stores work better together. Research shows that opening a brick-and-mortar store significantly increases a brand's online sales in that market. Physical locations serve as low-cost customer acquisition channels and provide sensory experiences that screens can't deliver.

Gen Z shoppers, the most digitally native generation, are driving foot traffic back to physical stores. They want social experiences, the ability to touch and try products, and "Instagrammable" moments that only physical spaces can provide.

The numbers tell the real story: record-low vacancy rates, rising rents, and strong consumer spending up 5.2% year-over-year. Well-located stores improve online sales through services like Buy Online, Pick Up In Store (BOPIS) and seamless returns.

Where are the best investment opportunities in retail real estate?

The smartest money is flowing into grocery-anchored neighborhood and community centers in high-growth markets nationwide. These properties offer stable income streams from necessity-based tenants that perform well regardless of economic conditions.

While Sun Belt markets have shown strong returns, the key drivers—population growth, job diversification, and favorable business climates—are creating opportunities in dynamic suburban and secondary markets across the country. The strategy is to focus on locations with strong demographic tailwinds, not just a specific region.

When you combine these fundamentals with the current supply shortage, you find opportunities for rent growth that can outpace inflation. Grocery-anchored centers are particularly attractive, often offering yield premiums over other commercial assets because they are recession-resistant and drive consistent foot traffic to surrounding tenants. The key is finding the right locations within these promising markets—something our AI Agent Waldo helps clients do by analyzing demographic trends, traffic patterns, and market dynamics simultaneously.

Conclusion: How to Capitalize on the Future of Retail

The story of retail real estate has taken a dramatic turn. What started as predictions of a "retail apocalypse" has become a tale of remarkable resilience and strategic reinvention. The retail real estate trends we've explored paint a picture of an industry that's not just surviving – it's thriving through intelligent adaptation.

Think about it: record-low vacancy rates, steady rent growth, and fierce competition for quality space. This isn't a dying industry. Instead, we're witnessing retailers accept smaller, experience-focused formats that blend digital convenience with physical touchpoints. We're seeing high-growth markets explode with opportunity while necessity retail proves its recession-resistant strength.

The winners in this new landscape share one crucial trait: they make data-driven decisions. Gone are the days of relying on gut feelings. Today's retail success demands understanding complex consumer behaviors, spotting micro-market opportunities, and optimizing every square foot.

The challenge isn't finding opportunities – it's analyzing them fast enough.

With limited new construction creating scarcity and most new leases being for smaller spaces, the competition for prime locations has never been fiercer. You need to evaluate more sites, faster, without sacrificing the deep analysis that separates winning locations from costly mistakes.

This is where technology becomes your competitive advantage. At GrowthFactor, we've built an AI-improved platform for this new reality. Our AI Agent Waldo enables your team to evaluate five times more sites efficiently, automating the qualification and evaluation processes that used to take weeks.

Whether you're a growing brand looking to expand or an established retailer adapting to new consumer preferences, our platform helps you pinpoint high-traffic areas and optimize store locations with precision. We offer flexible solutions starting with our Core plan at $500, scaling to Growth at $1,500, and custom Enterprise solutions.

The retail real estate trends reshaping our industry are accelerating. Population shifts to dynamic new markets, the rise of experiential retail, and omnichannel integration are creating opportunities every day. But only for those equipped to see them.

Leverage AI to find your next winning location for your retail brand. The future of retail is here, and it's powered by intelligence.

Citations

The human algorithm

Request Your demo

Schedule meeting

Or submit your information below and we'll be in touch to schedule.